There are two sides to everything in life, even credit cards. Sometimes it seems that all you hear about from friends or the media is debt horror stories about how credit cards completely ruined lives to the point of no return. Don’t panic! There are just as many good things that credit cards bring to the table as these shocking stories. Take a deep breath, because we are about to explore both the good and the bad of having a credit card.

Positives (+)

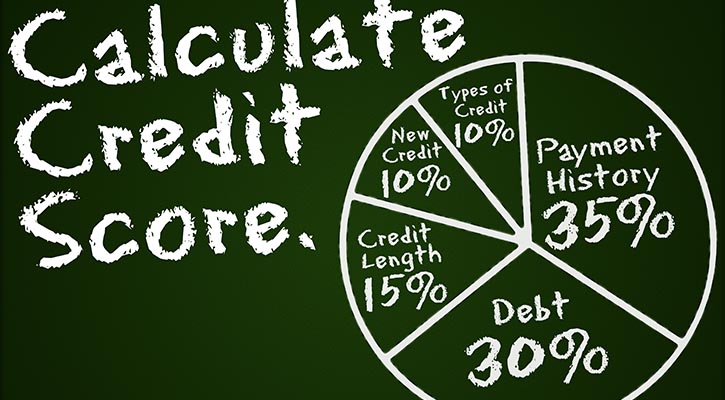

- Credit Building: It’s simple math: credit cards = credit score. Having a credit card automatically gives you a line of credit, and, if used wisely, you are on your way to building a solid credit foundation. You are going to need to have a line of credit established for when it’s time for you to make major purchases, like a car or home.

- Security: When using credit cards, all your transactions are saved in a payment history. Not only is this helpful for budgeting and tracking spending, but this makes it easy to spot potential identify theft. Unfortunately, in the environment in which we live, we need to err on the side of caution when it comes to credit card use. In the unfortunate event that a credit card does get stolen or lost, simply pick up the phone to call and cancel.

- Convenience: See something on the internet you have to have, but you have no credit card? Better get yourself to a store to buy a prepaid gift card or you are out of luck. Credit cards allow the freedom to shop through virtually any commerce medium, from over the phone purchases to online overseas impulse buys. You can even be granted the option for monthly installment payments on hefty expenses when using certain credit cards, adding to the convenience factor. You can also not only pay your bills, but participate in bill consolidation, making it even easier to stay on top of monthly expenditures.

Negatives (-)

- Convenience: Sometimes too much convenience is a bad thing. If you lack discipline and self-control, spending with a credit card can easily spiral out of control because of its “quick swipe” mentality (swipe it and forget about it!).

- Credit Crumbling: Credit cards can quickly damage your credit if you use them without restraint or wisdom. Late payments, missing payments, exceeding credit limits and so many more actions can harm your credit and get you into a fair amount of debt.

- Fees Fiasco: Not being a responsible credit card carrier can result in lots of late fees and interest payments, leaving you owing more money than what you started with.

The bottom line is that a fear of credit cards is more a fear of self-control. If you can be a smart spender, credit cards are helpful to establishing your financial identity instead of being detrimental. You have nothing to fear if you equip yourself with the tools to be wise with your money.