Why does it seem that, for so many people, credit cards are synonymous with fear? It seems like you mention the words to someone and they cringe at the thought of debt, interest rates, low credit score and all the various other fear factors that are all too common. Well, friends, we are here today to debunk some of these credit card urban legends to help you take a deep breath and realize that there is nothing to fear from credit cards.

Fear 1: Crushing Your Credit Score

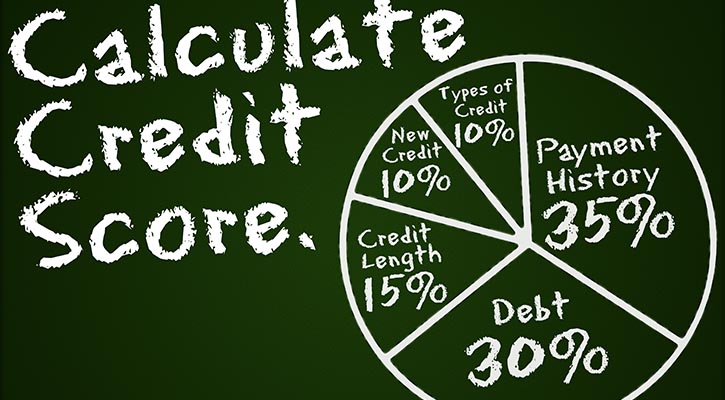

Probably the biggest fear with credit cards has to do with their assumed negative impact on your credit score. This fear is made out to seem like the act of applying for even one credit card will greatly damage your current credit score.

The reality is that your credit score will not be greatly damaged through applying for credit cards. The fear comes from the fact that when you apply for credit cards or loans something called a hard inquiry is run by the lender. In general, you would need to authorize a hard inquiry before they will proceed. This process can lower your credit score by just a few points and can remain on your credit history for up to 2 years. However, whatever “damage” that was done from the hard inquiry can slowly dissipate and rectify itself.

Fear 2: Incredibly High Interest Rates

Another all too common fear with credit cards is the idea that there will be such astronomical interest rates that go along with them that it’s not worth the trouble. The theme with this fear is that the interest will just accumulate in greater amounts over time and ultimately lead to debt.

The reality here is that there are ways to lower or even completely avoid interest payments with credit cards. Paying your balance in full and on time can avoid interest charges. Interest rates can also be negotiated with the credit card company, as well as having the option to transfer balances to a card with a lower rate.

This fear can be beat by doing research on the credit card company of your choice and learning all you can about the interest rate rules. This will help you make the best decision for you with no misconceptions about interest rates.

Fear 3: Drowning in Debt

A major yet misplaced fear about credit cards is the fear of them putting you in major debt; that it will be far too easy to spend too much money and, before you know it, you are swimming in a sea of debt and despair.

Good news! The reality here is that going into debt has absolutely nothing to do with credit cards, it has to do with YOU! As long as you hold yourself accountable, set a budget, utilize free credit checks to monitor your credit score, a credit card will do nothing to put you towards debt. You are the one who is in charge of your spending habits, not the plastic.