Starting college is almost like starting a new life. So many new experiences to embark upon, new found freedom, and more financial responsibility. It’s normal to feel like you need some advice on what to do to be a smart spender now that you’re on own, and you certainly aren’t alone. In 2015, it was expected that over 20 million students would enroll in American universities and colleges. Now is the time to start internalizing helpful financial tips to be as money savvy as possible throughout college and to lay the foundation for a wise spending future!

Budget

Get yourself prepared! Going to college with a budget and financial plan will help you stay on the right track with spending. It can be tricky to calculate outgoing expenses, especially when you’re first starting college life, but ease yourself into a conscientious spending mindset by calculating your income sources, funds from parents and savings.

Banking

Now that you have your budget all set, you need a place to start storing your cash. Do so research into the best banks that work with your school. Banks with online banking and mobile banking options are not only convenient, but also keep you more connected with your money so you can stick to your budget consistently. Be sure to look at out-of-network ATM fees in case you choose a bank that isn’t the closest to you. Many banks will also offer free checking accounts to college students.

Credit Card

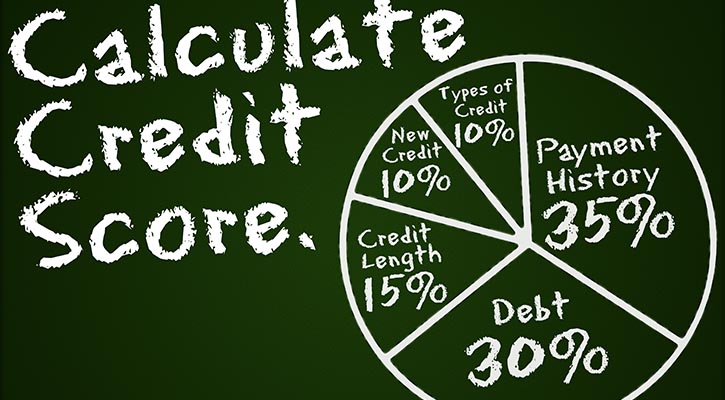

With your budget and banking in check, you should consider a credit card. Notice how we said “a credit card” and not “several credit cards.” It can be so easy to get sucked into the excitement when first starting college and want to jump on all the seemingly great credit card offers that are now available to you. Don’t rush! Make sure you read the fine print on everything and do your research. Look for benefits like cash back, low interest rates, or no annual fees. By making a smart first choice with a credit card, you are on your way to establishing a good college credit rating.

Discounts

Take pride in your college and show your spirit! Lots of college towns will provide discounts to students. Not only will becoming a discount hunter save you money during college, you will also begin to get in the habit for tracking down deals when making purchases; this is an invaluable skill to utilize through adult life.

Student Loans

Student loans are a great asset for college students, but they are to be used in moderation. Going crazy with applying for student loans will lead to extended debt, post-graduation. Not meeting payments or having loans go into deferment will negatively impact your credit rating. Only take the minimal amount of loans that you need to cover your school expenses. Read up about federal loan programs.

You should also check out scholarships and grants that could be available to you, especially as an incoming freshman. Sites such as My Education Guide can help you find and apply for grants that are applicable to you.

Textbooks

Being smart about buying textbooks is one of the best ways to save money as a college student. You should never pay for a new textbook unless you absolutely have to. Try to find used copies in the bookstore and save a significant amount of money on this class necessity. In fact, try bypassing the campus bookstore completely. It tends to be the most expensive option for getting the textbooks you need. Look into online options, like downloading books or ordering books online.

You can sell your books back at the end of the semester as well. This can be done through the bookstores or online, and it gives you an opportunity to make some money back on a book that you won’t need to look at again. Saving space and money at the same time, what could be better?