Are you in the market for a credit card, a car loan, or a mortgage? If so, any bank or other lending institutions will look at your credit score as a major part of their decision about loaning the money to you. It makes sense to know what your credit score is, how it is arrived at, and what you can do to improve it, if you need to.

What Is a Credit Score?

Simply put, a credit score is a number between 300 and 850 that indicates how credit-worthy you are. Any number above 740 is considered excellent. You are very likely to receive the credit card, car loan, or mortgage you’re applying for if you have this score and a job.

However, a credit score of 650 or below is on the poor side. If you have a score between 300 and 650, your application for credit may be turned down. Or, if you receive it, a bank or lending institution may charge you a higher interest rate. In their eyes, this is justified: Your credit score indicates that you’re a higher risk than a neighbor whose credit score is higher.

What about the average scores? How can you bring your scores up if they are currently less than ideal?

How Credit Scores Are Determined

It’s not so easy to know exactly how credit scores are determined. Most credit scores come from a company named FICO. FICO calculates scores. Behind FICO is a the company that created it, Fair Isaac. Just as Colonel Saunders never let slip the herbs and spices in Kentucky Fried Chicken, Fair Issac never lets out exactly how the FICO score works.

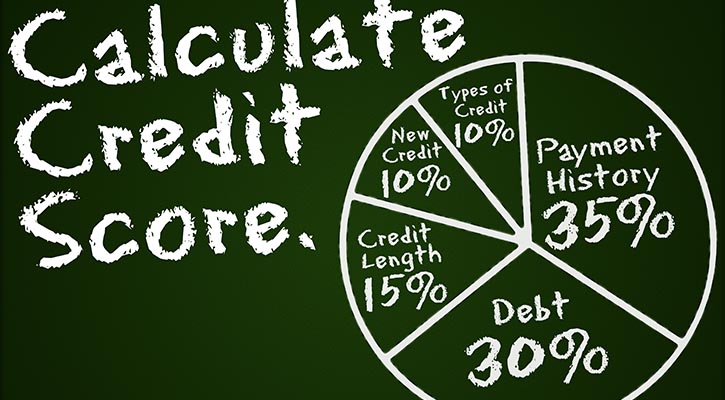

It has, though, revealed the criteria that are used and what percentage of the total score those criteria make up.

Of your total FICO score, your payment history contributes 35%, the total amount you owe makes up 30%, length of credit history makes up 15%, new credit contributes 10%, and types of credit used accounts for 10%.

Let’s look a little closer at these. Payment history, the biggest percentage, just means that FICO takes into account whether you pay on time. Amount owned, the second category, examines what credit folks call a “utilization ratio.” They are looking at how much credit you use versus how much you have available. Why? Because borrowers who max out all their credit miss payments more often, in the eyes of the banks. Therefore, if you have credit cards, but carry a small balance, it likely affects your FICO score favorably.

Length of credit history takes into account the average age of the credit you have as well as when you last used it.

New credit means how many new accounts you have opened, whether they are credit cards, student loans, mortgages, and so on. A lot of recent new accounts can send your score south (because it indicates you really need credit badly). A good mix of credit in the eyes of the banks can be good for your score, because it indicates you’re responsible with many different types of credit.

Trying to understand can be frustrating. If you have a 0 credit card balance, for example, you might think it would help your credit score. It doesn’t. The impact is negative, perhaps because lenders want some information on how you handle credit.

Raising Your Score

Can you raise your credit score? Definitely. Even if you’ve had late payments, once you start making them on time, the score rises. The key is to check your credit score, pay on time, and use a responsible amount of credit.

Are you in the market for credit right now? See our top credit card offers.