Unemployment: it’s a word that you can never feel good about saying or hearing. There is no positive that comes out of being unemployed, especially when it comes as a total shock with no time to prepare. One of the first things that strike when you are faced with unemployment is the panic about how you will take care of your financial responsibilities. Then you’re hit with the massive responsibility of the need for meticulous money management.

Take a deep breath. You are not alone. As of May of this year, the national unemployment rate was at 4.7%. That’s approximately 15 million people. Yes, million. We are here to help you get some peace of mind with three great pieces of advice on how to handle your finances while experiencing unemployment. Take another deep breath, and let’s get going.

Be Communicative

Keeping an open line of communication with your credit card company is imperative during periods of unemployment. The last thing you want to happen is to have your credit cards turned over to collections, which would be devastating to your credit score. By being open with your situation, you have the potential for the creditors to be flexible with things such as changing your payment due date or negotiating a smaller minimum payment. You’ll never know if you don’t ask, right?

Be Restrained

You always want to strive to be a smart spender, but this is of increased importance when unemployed. There is no way to predict how long it will take to find a new job, which makes it very difficult to budget realistically. You want to make sure you are planning for the worst but striving for the best when hunting for a job and maintaining your everyday life.

Take your self-control with your credit cards to the next level by prioritizing. You need to spend on priority expenses before all else. If you happen to have some extra cash left over each month after taking care of all needed payments, make sure to continue to hold onto self-control and not splurge. You never know what unexpected event could occur before you are working again, and you don’t want to suffer irreparable credit score damage because of being forced to use credit cards excessively.

Be Informed

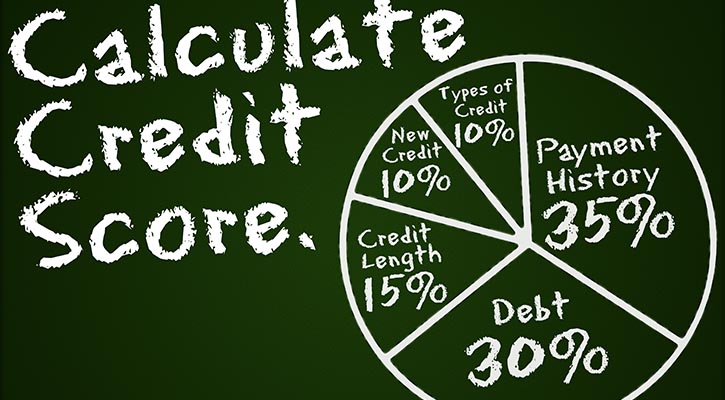

Never forget to utilize a free credit check! Keeping yourself informed of your financial status during this difficult time is of paramount importance, not just for your finances but for future job potential. Many employers will run a credit check on potential candidates for employment, and you need to be completely educated on items that could be considered “red flag” material to a possible employer. Being ever vigilant with a free credit check will also help you be extra cautious when you spend with credit cards during your period of unemployment.

Services such as My Unemployment Helper can help you navigate through your difficult time. Don’t forget to take deep breaths and keep motivated!