Month: July 2024

How to Save Money Without Realizing It

Everyone knows that they need to be saving money and setting it aside for future emergencies. If you have savings built up, unexpected expenses won’t [more…]

Credit Card Do’s and Don’ts

Getting a credit card can be exciting. But don’t confuse credit with “free money,” because that’s not what this is at all. Credit cards give [more…]

How to Tame Your Money

How much of your time do you spend thinking or worrying about money? According to a report by the American Psychological Association, 72% of [more…]

Will Somebody Give a Young Guy a Little Credit?

It doesn’t seem fair. You’ve avoided temptation and refrained from spending all your money on frivolous pursuits. And you’ve worked hard to graduate from high [more…]

Thinking About a Credit Card for Your New Business?

One thing that most small businesses have in common? They don’t want to stay small for long. Small business owners aim to grow their enterprises. [more…]

Confused by Credit Score vs. Credit Worthiness? This is the Difference.

Credit: the word that inspires both nervousness and necessity when heard. Credit is a huge part of modern life, and our credit identity is the [more…]

3 Reasons Why You Should Not Cut Up or Cancel Your Credit Cards

The best credit cards are active credit cards, even if you have debt! The last thing you want to do is cut up a credit [more…]

The Stats of Credit Scores: Where Do You Fall?

So, you know your credit score. But do you know how your credit score stacks up with your peers? How about against your parents? Or [more…]

Put Down the Plastic! 3 Items You Should NOT Purchase with Credit Cards

We all love having conveniences in our lives, right? Especially when it comes to spending. That’s one of the main reasons we love having credit [more…]

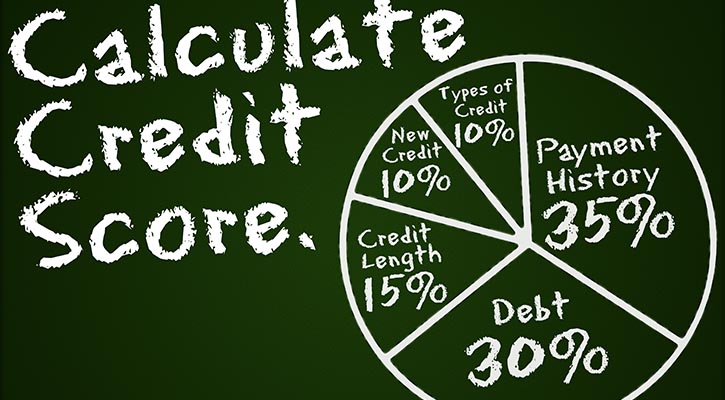

The Secret Herbs and Spices in Your Credit Score

Are you in the market for a credit card, a car loan, or a mortgage? If so, any bank or other lending institutions will look [more…]